Updated {date_0}

Updated {date_0}

Updated {date_0}

Updated {date_0}

Updated {date_0}

Updated {date_0}

## Quick Start

The Bundle API accepts an array of actions that execute sequentially. Each action can use outputs from previous actions, enabling complex workflows impossible with separate transactions.

## Quick Start

The Bundle API accepts an array of actions that execute sequentially. Each action can use outputs from previous actions, enabling complex workflows impossible with separate transactions.

Updated {date_0}

Updated {date_0}

## Quick Start

The `route` API produces an gas-optimized, atomic transaction between the two given positions, combining `swap`, `deposit`, and `redeem` operations.

## Quick Start

The `route` API produces an gas-optimized, atomic transaction between the two given positions, combining `swap`, `deposit`, and `redeem` operations.

Updated {date_0}

To get a list of actions available for a specific protocol, use [GET `standards/{slug}/`](https://docs.enso.build/api-reference/integration/standard-per-protocol).

Updated {date_0}

Updated {date_0}

| Network | Router V2 | Delegate V2 |

|---|---|---|

| Ethereum | `0xF75584eF6673aD213a685a1B58Cc0330B8eA22Cf` | `0x7663fd40081dcCd47805c00e613B6beAc3B87F08` |

| Optimism | `0xF75584eF6673aD213a685a1B58Cc0330B8eA22Cf` | `0x7663fd40081dcCd47805c00e613B6beAc3B87F08` |

| Binance | `0xF75584eF6673aD213a685a1B58Cc0330B8eA22Cf` | `0x7663fd40081dcCd47805c00e613B6beAc3B87F08` |

| Gnosis | `0xF75584eF6673aD213a685a1B58Cc0330B8eA22Cf` | `0x7663fd40081dcCd47805c00e613B6beAc3B87F08` |

| Unichain | `0xF75584eF6673aD213a685a1B58Cc0330B8eA22Cf` | `0x7663fd40081dcCd47805c00e613B6beAc3B87F08` |

| Polygon | `0xF75584eF6673aD213a685a1B58Cc0330B8eA22Cf` | `0x7663fd40081dcCd47805c00e613B6beAc3B87F08` |

| Sonic | `0xF75584eF6673aD213a685a1B58Cc0330B8eA22Cf` | `0x7663fd40081dcCd47805c00e613B6beAc3B87F08` |

| ZkSync | `0x1BD8CefD703CF6b8fF886AD2E32653C32bc62b5C` | `0x4c3Db0fFf66f98d84429Bf60E7622e206Fc4947c` |

| World | `0xF75584eF6673aD213a685a1B58Cc0330B8eA22Cf` | `0x7663fd40081dcCd47805c00e613B6beAc3B87F08` |

| Hyper | `0xF75584eF6673aD213a685a1B58Cc0330B8eA22Cf` | `0x7663fd40081dcCd47805c00e613B6beAc3B87F08` |

| Soneium | `0xF75584eF6673aD213a685a1B58Cc0330B8eA22Cf` | `0x7663fd40081dcCd47805c00e613B6beAc3B87F08` |

| Base | `0xF75584eF6673aD213a685a1B58Cc0330B8eA22Cf` | `0x7663fd40081dcCd47805c00e613B6beAc3B87F08` |

| Arbitrum | `0xF75584eF6673aD213a685a1B58Cc0330B8eA22Cf` | `0x7663fd40081dcCd47805c00e613B6beAc3B87F08` |

| Avalanche | `0xF75584eF6673aD213a685a1B58Cc0330B8eA22Cf` | `0x7663fd40081dcCd47805c00e613B6beAc3B87F08` |

| Ink | `0xF75584eF6673aD213a685a1B58Cc0330B8eA22Cf` | `0x7663fd40081dcCd47805c00e613B6beAc3B87F08` |

| Linea | `0xA146d46823f3F594B785200102Be5385CAfCE9B5` | `0xEe41aB55411a957c43C469F74867fa4671F9f017` |

| Berachain | `0xF75584eF6673aD213a685a1B58Cc0330B8eA22Cf` | `0x7663fd40081dcCd47805c00e613B6beAc3B87F08` |

| Sepolia | `0xF75584eF6673aD213a685a1B58Cc0330B8eA22Cf` | `0x7663fd40081dcCd47805c00e613B6beAc3B87F08` |

| Network | Router V1 | Delegate V1 |

|---|---|---|

| Ethereum | `0x80EbA3855878739F4710233A8a19d89Bdd2ffB8E` | `0x38147794ff247e5fc179edbae6c37fff88f68c52` |

| Optimism | `0x80EbA3855878739F4710233A8a19d89Bdd2ffB8E` | `0x38147794ff247e5fc179edbae6c37fff88f68c52` |

| Binance | `0x80EbA3855878739F4710233A8a19d89Bdd2ffB8E` | `0x38147794ff247e5fc179edbae6c37fff88f68c52` |

| Gnosis | `0x80EbA3855878739F4710233A8a19d89Bdd2ffB8E` | `0x38147794ff247e5fc179edbae6c37fff88f68c52` |

| Unichain | - | - |

| Polygon | `0x80EbA3855878739F4710233A8a19d89Bdd2ffB8E` | `0x38147794ff247e5fc179edbae6c37fff88f68c52` |

| Sonic | `0x80EbA3855878739F4710233A8a19d89Bdd2ffB8E` | `0x38147794ff247e5fc179edbae6c37fff88f68c52` |

| ZkSync | `0xd12ecDD67300D5ef0A68576CfDF038bAB5b5054a` | `0x43BD12326142568D5Cc33c7326A68Ca4e0be9292` |

| World | - | - |

| Hyper | `0x80EbA3855878739F4710233A8a19d89Bdd2ffB8E` | `0x38147794ff247e5fc179edbae6c37fff88f68c52` |

| Soneium | - | - |

| Base | `0x80EbA3855878739F4710233A8a19d89Bdd2ffB8E` | `0x38147794ff247e5fc179edbae6c37fff88f68c52` |

| Arbitrum | `0x80EbA3855878739F4710233A8a19d89Bdd2ffB8E` | `0x38147794ff247e5fc179edbae6c37fff88f68c52` |

| Avalanche | `0x80EbA3855878739F4710233A8a19d89Bdd2ffB8E` | `0x38147794ff247e5fc179edbae6c37fff88f68c52` |

| Ink | - | - |

| Linea | `0x80EbA3855878739F4710233A8a19d89Bdd2ffB8E` | `0x38147794ff247e5fc179edbae6c37fff88f68c52` |

| Berachain | `0x80EbA3855878739F4710233A8a19d89Bdd2ffB8E` | `0x38147794ff247e5fc179edbae6c37fff88f68c52` |

| Sepolia | - | - |

Updated {date_0}

Updated {date_0}

Updated {date_0}

Updated {date_0}

Updated {date_0}

Updated {date_0}

Updated {date_0}

## Integrate

Follow these steps to integrate the Cross-Chain Route Widget into your React application.

## Integrate

Follow these steps to integrate the Cross-Chain Route Widget into your React application.

Install the package:

```bash npm install @ensofinance/shortcuts-widget ```Updated {date_0}

Updated {date_0}

{/* lorem */}

{/* lorem */}

{/* ipsum */}

Updated {date_0}

Updated {date_0}

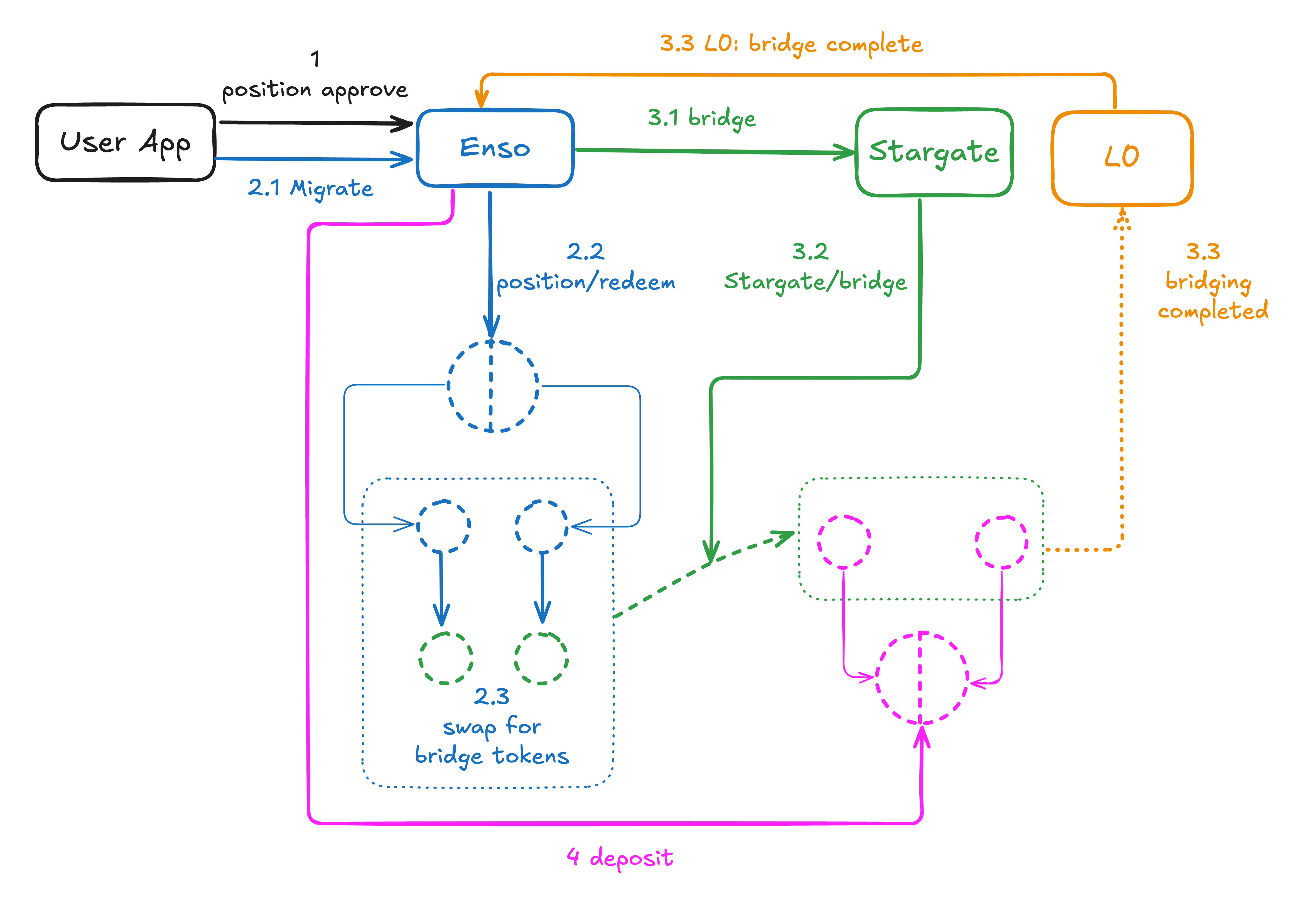

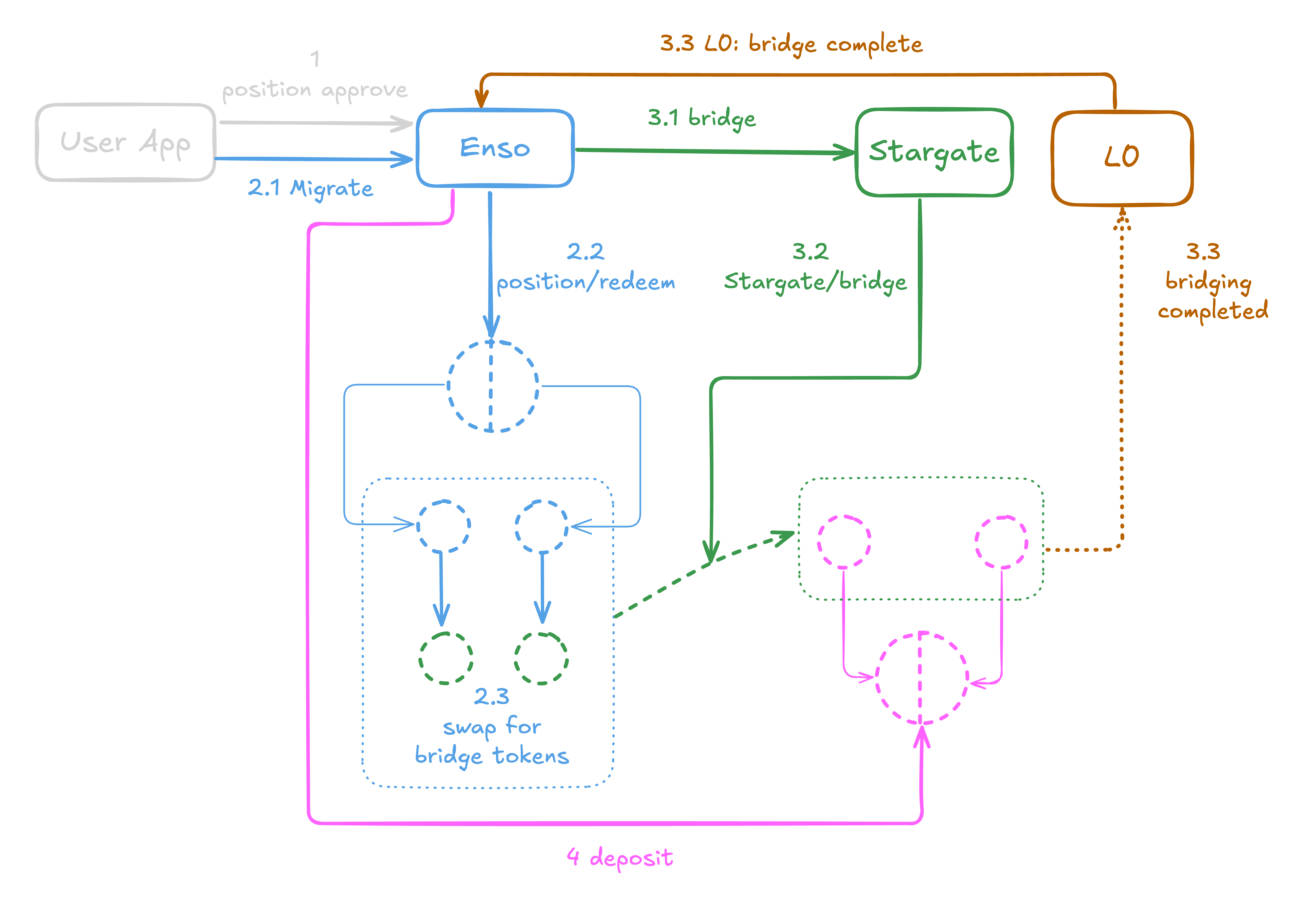

2. The user initiates the migration.

2.1. The user initiates the migration.

Enso issues a [transaction bundle](/pages/build/get-started/bundling-actions) that:

2.2. [Redeems](/pages/build/reference/actions#redeem) the assets underlying the user's position on Uniswap V3.

2.3. Swaps the assets to bridge tokens.

3. Bridging takes place

3.1. Enso sends the assets to Stargate.

3.2. Stargate bridges them to the destination chain.

3.3. Stargate notifies Layer0, which notifies Enso.

4. Enso issues a transaction on the destination chain that deposits the assets into the destination V4 pool.

## Integrate

To integrate the Uniswap yield migrator widget, follow the steps below.

## Integrate

To integrate the Uniswap yield migrator widget, follow the steps below.

Updated {date_0}

Updated {date_0}

Updated {date_0}