tokenIn and tokenOut. Whether you’re swapping tokens, entering yield vaults, or moving assets across chains, the Route API handles the complex routing logic automatically.

Routing vs Bundling: The Route API excels at single-path operations where you want Enso to determine the optimal route automatically. For custom multi-step workflows where you need precise control over each action, use the Bundle API instead.

When to use routing: Token swaps with optimal pricing, vault entries/exits, position migrations between protocols, crosschain transfers, and any scenario where you want automated route optimization rather than manually specifying each step.

Quick Start

Theroute API produces an gas-optimized, atomic transaction between the two given positions, combining swap, deposit, and redeem operations.

Use the Bundle API if you need other actions Enso supports, such as

harvest, borrow, repay.Sample requests

- Token Swap

- Vault Entry (Zap)

- Crosschain swap

- Crosschain Vault Zap

Core Concepts

Input/Output Model

Specify any

tokenIn and tokenOut - ERC20 tokens, LP tokens, vault shares, or yield positions. The Route API automatically finds the optimal path between any two DeFi positions across protocols and chains.Response

Response contains a complete transaction object ready to sign (

tx), amountOut (expected output), gas (estimated), and route (optimized path taken).Slippage Control

Set slippage in basis points:

"50" = 0.5%, "300" = 3%. Higher slippage for complex routes. Cannot use both slippage and minAmountOut - choose one protection method.Crosschain Operations

Add

destinationChainId for crosschain routes. API automatically selects optimal bridges and calculates fees.Response Structure

Theroute response consists of the following fields:

tx: Complete transaction object ready for submission. Contains the correcttoaddress,data,value, andgasfields.amountOut: Simulated output amount - display this to users as expected returns. This is calculated through onchain simulation.gas: Estimated gas usage from simulation. Use this value to prevent out-of-gas failures.route: Array showing the optimization path Enso constructed. Shows the DEX(s) Enso selected for optimal pricing.

Examples

The following examples progress from simple token swaps to complex crosschain vault interactions. Each example builds on concepts from previous ones, demonstrating how the Route API handles increasingly sophisticated DeFi operations automatically.0. Install & Authenticate

You can interact with the API using Enso SDK or directly via a REST API. You can explore Enso through API Sandbox. To install the SDK run the following command:1. Simple Token Swap

Start with the most basic routing operation: swapping ETH for USDC on Ethereum mainnet.SDK

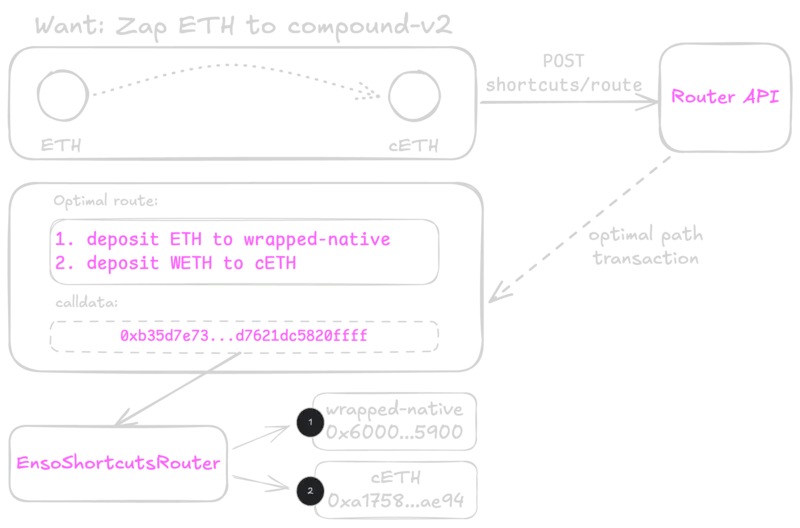

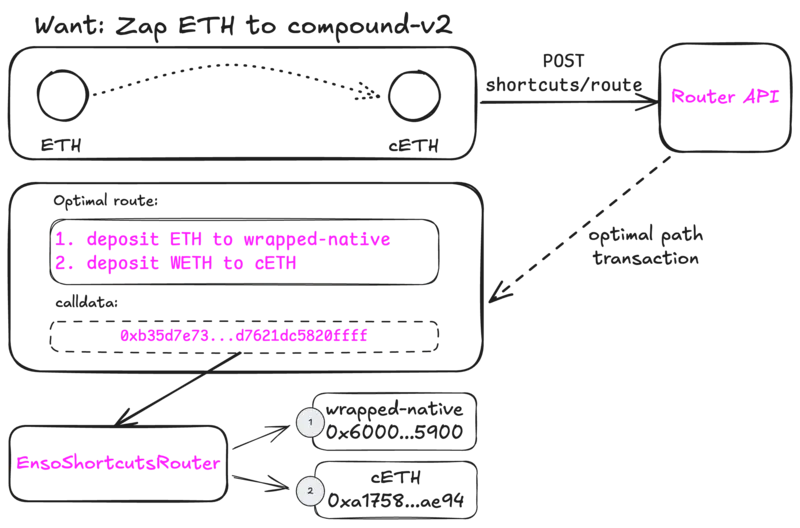

2. Zap into Vault

Enter a Yearn vault directly from ETH, automatically handling any intermediate swaps and vault deposits.SDK

amountOut represents vault shares, not underlying tokens.

3. Vault Migration

Move from one yield protocol to another - exit Yearn vault and enter Aave lending position.SDK

4. Crosschain Transfer

Move assets between blockchains using Enso’s integrated bridge routing.SDK

feeAmount shows bridge costs, and route reveals pre- and post- bridging steps.

5. Crosschain Vault Zapping

The most complex example: bridge assets and enter a vault on the destination chain in one transaction.SDK

Related APIs & Next Steps

When to Use Other APIs

- Bundle API: When you need custom multi-step logic or want to orchestrate specific actions in sequence, or you need actions beyond

swap,depositandredeemthe route API uses - Nontokenized Positions: For lending positions that don’t issue tokens (like Aave debt positions)

- Approval Endpoint: Managing token permissions when using

"router"strategy

Supporting APIs

- Tokens API: Discover available tokens and their addresses across chains

- Prices API: Get current token valuations for your UI

- Networks API: List supported chains and their details

Updated